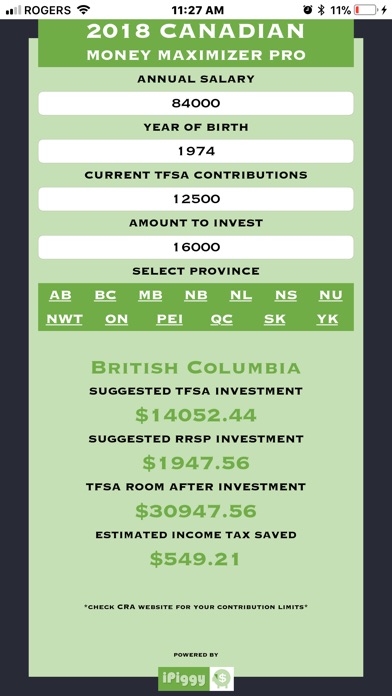

Canadian Money Maximizer PRO app for iPhone and iPad

Developer: Nic Tustin

First release : 15 Nov 2017

App size: 8.4 Mb

"THIS LITTLE PIGGY HATES 2018 INCOME TAX"

Start planning your 2018 finances today!

Canadians have different jobs. Canadians have different incomes. Some Canadians have pensions. Some Canadians have children. Every Canadian saves and spends differently; everyones financial situation unique. The only constant when it comes to your income is the tax thats taken off of it. Let us help you with an easy strategy to maximize your net income!

This app will help you pay the least amount of income tax throughout your lifetime! Canada is unique in the fact that it has two different registered portfolio products which have properties that act in opposite ways. Due to the nature of these products there is an algorithm thats helps you maximize current and future income by minimizing the amount of taxes you pay. Find out if that mutual fund that youve been thinking about belongs in your TFSA( Tax Free Savings Account) and/or RRSP ( Registered Retirement Savings Plan).

TFSA have specific limits depending on how old you are and each province has their own tax rate. There is a specific value tailored to where you live and the app always checks to make sure you dont over contribute to your TFSA.

Think of a TFSA as an Tax Free "Investment" Account. Securities, mutual fundscan be purchased in this register product and the best part is... no tax! Any profits gained inside a TFSA is tax free income.

HINT: Try putting higher risk investments in TFSAs to really benefit from the tax free aspects of these registered accounts.

If youre a millennial... TFSAs are your best friend. If youre going to collect a pension... TFSAs are your best friend. Unlike RRSPs, pulling out money in retirement from a TFSA does not affect taxable income .

TFSAs are also a great tool to build a safety net for a rainy day or an emergency fund as the funds withdrawn from the TFSA portfolio are not added to your yearly income and are not taxed.

Plain and simple... RRSPs help you reduce the income you pay now... but you pay the tax in retirement when you are in a lower tax bracket.

Let Canadian Money Maximizer PRO find your financial "sweet spot" today!

This app takes the guess work out of your investment strategy. It calculates, to the nearest penny, how much of your investment should be contributed to a TFSA or RRSP, to truly maximize your money.